How people see coincidence as destiny

Copyright © 2010, Paul Lutus — Message Page

Introduction | The Gambler's Fallacy | Friday the 13th

The Birthday Problem | Amazing Rock | Investment Genius

Miracle Man | References (double-click any word to see its definition)

Copyright © 2010, Paul Lutus — Message Page

Introduction | The Gambler's Fallacy | Friday the 13th

The Birthday Problem | Amazing Rock | Investment Genius

Miracle Man | References (double-click any word to see its definition)

This article describes how, in our search for order and purpose in life, people sometimes assign meaning to events that are objectively random and devoid of meaning. Consider these two images — one dot pattern is random, the other isn't:

Sample A |  Sample B |

In perception studies, most people choose Sample A because Sample B shows tight clusters of dots that don't really seem random. But it turns out that Sample A has been artificially arranged to avoid normal clustering, and Sample B shows a truly random ordering of dots.

The meaning of this experiment is that, when people see tight clusters of dots (or of events), they conclude it isn't a chance grouping but has special significance. But in reality and in nature, events often cluster purely by chance.

The following sections show examples where, for psychological reasons, people assign meaning to meaningless groupings, significance to insignificant coincidences, even invest in outright frauds based on mistaken perceptions of reality.

Here's how it works — let's say we flip a fair coin, one that has an equal chance of coming up heads or tails. By definition, the probability for heads on the first flip is 0.5 or ½. Now think about these questions:

- If you have just gotten one heads result, what is the probability for heads on the next flip?

- If you have just gotten one tails result, what is the probability for heads on the next flip?

- If you have just gotten eight heads results in a row, what is the probability for heads on the next flip?

- The probability of tossing eight heads in a row is 2-8, or 1/256.

- But during the eight coin tosses, the probability of each new heads result considered separately is ½.

I've often wondered whether an education in math might cure the Gambler's Fallacy.

Is Friday the 13th really more risky than another day? If we look for anecdotes meant to show the dangers of Friday the 13th, we will likely find some, but they may not mean what we think:

The Birthday Problem - The probability that there will be a Friday the 13th during any given month is equal to the reciprocal of the number of weekdays: 1/7 or 14.1%.

- The average number of Friday the 13ths in a year is equal to the number of months divided by the number of weekdays: 12/7 or 1.71.

- The average probability that a given day will turn out to be Friday the 13th is equal to the average number of Friday the 13ths in a year, divided by the average number of days in a year: 1.71 / 365.25 or 0.468%. For simplicity, let's call this 0.5%, ½ of one percent.

- Let's give this a personal context. Let's say that a subject (who we will call John) is very careful and/or lucky, and therefore has a memorably bad experience only every 100 days on average. Given that there is only a half-percent chance that this bad experience will fall on a Friday the 13th, there is little chance to argue for a connection.

- Let's say that careful John reviews his life on his 70th birthday and recalls 365.25 * 70 / 100 (255.67) bad experiences. Given the ½% probability that any particular day will be a Friday the 13th, John may be able to recall 255.67 * 0.005 = 1.28 occasions where those bad experiences fell on a Friday the 13th.

- If John is mathematically and logically inclined, he will disregard an occasion where a bad experience coincided with Friday the 13th, realizing it was coincidental.

- But if John is superstitious or irrational, he might argue that the one example proves Friday the 13th is really a more dangerous day than average.

- Assembled with John on his 70th birthday are 100 friends of similar age and behavior. Based on the foregoing, between them they might recall 128 occasions where a bad experience fell on Friday the 13th. Given the level of scientific literacy in modern society, what is the probability than none of the 100 friends will draw an irrational conclusion?

A question: how many people need to be gathered in a room for a 50% probability that two of them share the same birthday?

This is a perfect example of the disconnect between everyday perceptions and reality. When people first encounter this question, they usually think along these lines (for simplicity's sake let's disregard leap year):

Amazing Rock This is a perfect example of the disconnect between everyday perceptions and reality. When people first encounter this question, they usually think along these lines (for simplicity's sake let's disregard leap year):

- Even with 365 people present, there is a small possibility that all of them will have different birthdates, so the probability isn't 100% even then.

- For a particular person (let's call him "John"), at first glance it would seem that 365 / 2 (182.5) people would be needed for a 50 % probability of matching John's birthdate.

- But the above estimate overlooks the possibility that others in the room might have matching birthdates, which reduces the number of possible matches for John's birthdate.

- For reasons given here and to accommodate the possibility of other matching birthdates, we need 253 people to assure a 50% probability of matching John's birthdate.

- The birthdate of each of the 23 people may be compared to the birthdates of the remaining 22 people.

- By this reckoning, the number of possible pairings is 23 * 22 / 2 = 253.

- On the basis of the analysis above and detailed here, 253 pairings is just enough to meet the 50% probability that two of the 23 people will have the same birthdate.

- So, contrary to our instincts, 23 people is enough.

Face Rock

57° 23.959' N, 153° 50.904' W,

West shore of Uyak Inlet, Kodiak Island.

57° 23.959' N, 153° 50.904' W,

West shore of Uyak Inlet, Kodiak Island.

Some may argue that such a rock, with a clearly sculpted face, couldn't possibly happen by chance — it's too much like a human face to be a coincidence. Others may argue that the chance for a rock to have this shape is, oh, ten million to one, therefore it's proof that aliens visited and sculpted it.

But remember Occam's razor, the idea that the simplest explanation is most likely to be right. Maybe the explanation is that during my world travels I had encountered ten million rocks, meaning my chance to see a random face in a rock had acquired a probability of 50%.

At the time of writing I've been boating and hiking for about 60 years, and I see all sorts of approximate faces in rocks and landscapes, just not very convincing ones — until that day in 2004 when I paddled past the rock shown on this page.

I emphasize only one particular viewing angle works — the first time I saw the face, my kayak was still moving and the face disappeared as fast as it appeared. I paddled backward slowly, framed the face perfectly and snapped the picture. Because the view of the face depends so much on being in a particular spot, and because of its location in a wild part of Alaska, I doubt anyone ever noticed it before I did, in particular because one must be in a shallow-water boat like a kayak. (Read more about this specific outing here.)

An interesting coincidence, but still a coincidence.

As it happens, it is not possible to publish an effective strategy for stock trading, because once the strategy is published, it must fail (because everyone will start practicing it, thus destroying its effectiveness). This is obviously true, but based on the number of "Secrets of the Winners" investment books for sale, it's obvious that people haven't figured this out.

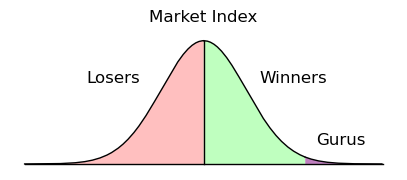

But if there are no legitimate public winning strategies, if instead it's a fair market and everyone has the same opportunity for success, how can some people become multimillionaires while others lose their money? That can't be because of chance, can it?

Well, as a matter of fact, yes, investment success can and does result from pure chance, and stories of investment success are much more likely to result from chance than genius.

Because everyone is trying to outwit everyone else in unpredictable ways, the stock market is much more a random process than a moral drama with predictable winners and losers. But even though the market doesn't (and cannot) reward investment ingenuity, it does pay attention to chance factors.

And this is easily demonstrated — a typical stock market can easily be modeled with a computer program. Let's examine such a model (click here to see the program listing):

- In the model, the average market value increases by 12% per year (compounded weekly), a typical long-term growth pattern.

- The values of individual stocks randomly fluctuate up and down over time, but over time they track the market average.

- The simulation models the progress of 100,000 investors, each with an initial $10,000 stake.

- Investors buy and sell stocks randomly, without any hint of an investment strategy.

- No transaction fees are charged on trades.

- The simulation runs for 20 years.

- The worst portfolio of the 100,000 active traders was worth $1,451.16.

- The best portfolio was worth $4,638,235.88.

- A "buy & hold" investor, one who simply purchased stocks and sat on them for twenty years, never trading, made $109,927.40, roughly 11 times his initial stake (not accounting for inflation).

- Active traders who did worse than the "buy & hold" investor: 67,783 (68%).

- Active traders who did better than the "buy & hold" investor: 32,217 (32%).

- Active traders who became millionaires: 224 (0.22%).

Given this bleak forecast for active investors compared to buy & hold investors, how do stockbrokers stay in business? That's easy — they lie. Instead of confessing that a typical investor will come out behind the market average (even with no brokerage fees), they correctly point out that some investors become millionaires. Every stockbroker has a few stories like the best outcome in this simulation — the lucky investor who started out with $10,000 and ended up with $4,638,235.88 (an increase of about 464 times). But this truth cannot erase a more important truth — that on average, a buy & hold investor will do better than an active trader.

The above model doesn't take into account the idea that a stockbroker knows more about investing than the average investor, and that hiring a stockbroker is smarter than making personal investment choices. But is this true — is the expertise of the stockbroker worth his cost? In a word, no — the now-famous Wall Street Journal Dartboard Contest posited that a blindfolded investor throwing darts at a list of stocks would do as well as a professional stockbroker, at no cost. In a multi-year trial, The Wall Street Journal concluded:

" ... the performance of the pros versus the Dow Jones Industrial Average was less impressive. The pros barely edged the DJIA by a margin of 51 to 49 contests. In other words, simply investing passively in the Dow, an investor would have beaten the picks of the pros in roughly half the contests (that is, without even considering transactions costs or taxes for taxable investors)."In short, if one hires a stockbroker and must pay transaction fees, the best evidence is such an investor will not do as well as a buy & hold investor, who doesn't lose any sleep about what his stockbroker might be doing with his money.

Random Market Outcomes

But in truth, if an investor came up with an effective investment strategy that had proved itself, he would keep it a secret (because revealing such a strategy always ruins it). Remember this when you see someone crowing about his wonderful investment book — if it had any value, it wouldn't be offered for sale.

But Miracle Man is braver than most — his mailing includes a prediction about which direction the Dow index will be moving in the coming month (up or down). That's not a common thing — most counselors try to avoid making a clear prediction that can be falsified in 30 days.

To your complete shock, Miracle Man mails you a prediction every month for six months, every one contains a prediction about the direction of the Dow for the coming month, and every one of them is right. You realize too late that if you had acted on Miracle Man's predictions and moved your assets according to his instructions, you would have made millions of dollars. In the final mailing, along with another correct prediction, Miracle Man offers to take over your portfolio. You are an intelligent, educated person, many things sound too good to be true, but in this case, he has mailed you an accurate prediction about the future of the Dow, every month for six months. He must be the real thing.

But before you sign your assets over to Miracle Man, I have to tell you this is just another scam — it's ingenious and convincing, but it's a scam. As it happens, anyone can produce a run of what seem to be accurate Dow predictions, in fact a computer can do this trick without human interference. Here's how:

- Miracle Man gets a list of names and addresses of investors that is a power of 2. Let's say 215 = 32,768. He needs a power of two so he can divide the list repeatedly.

- He splits the address list in two.

- He mails one list a prediction that the Dow will fall, the other a prediction that the Dow will rise.

- At the end of the month, he discards the names that got an incorrect prediction, and repeats from step (2) above.

- At the end of six months, Miracle Man has a list of 256 names, each of whom has gotten a series of six miraculous predictions that could have netted the recipients millions of dollars if they had moved in a timely way.

Even in a clever example like this, common sense and skepticism can help expose a scam:

- If Miracle Man is able to predict the Dow with complete accuracy, why does he want to control your portfolio? He should be able to use this ability to enrich himself without your help.

- If there is a way to predict the Dow's direction with perfect accuracy, doesn't this mean the market is broken? Wouldn't this conclusively invalidate the Efficient Market Hypothesis?

- It is well-known that published investment methods fail by being revealed, so the method being used is either published or its strategy will be revealed by the market moves of Miracle Man, and either way, that would destroy the method's effectiveness. This can only mean Miracle Man isn't practicing his own method.

- If anyone could make millions of dollars based on monthly, perfectly accurate predictions, the market would collapse. So something is rotten in Denmark.

No comments:

Post a Comment